Retirement All In One Place

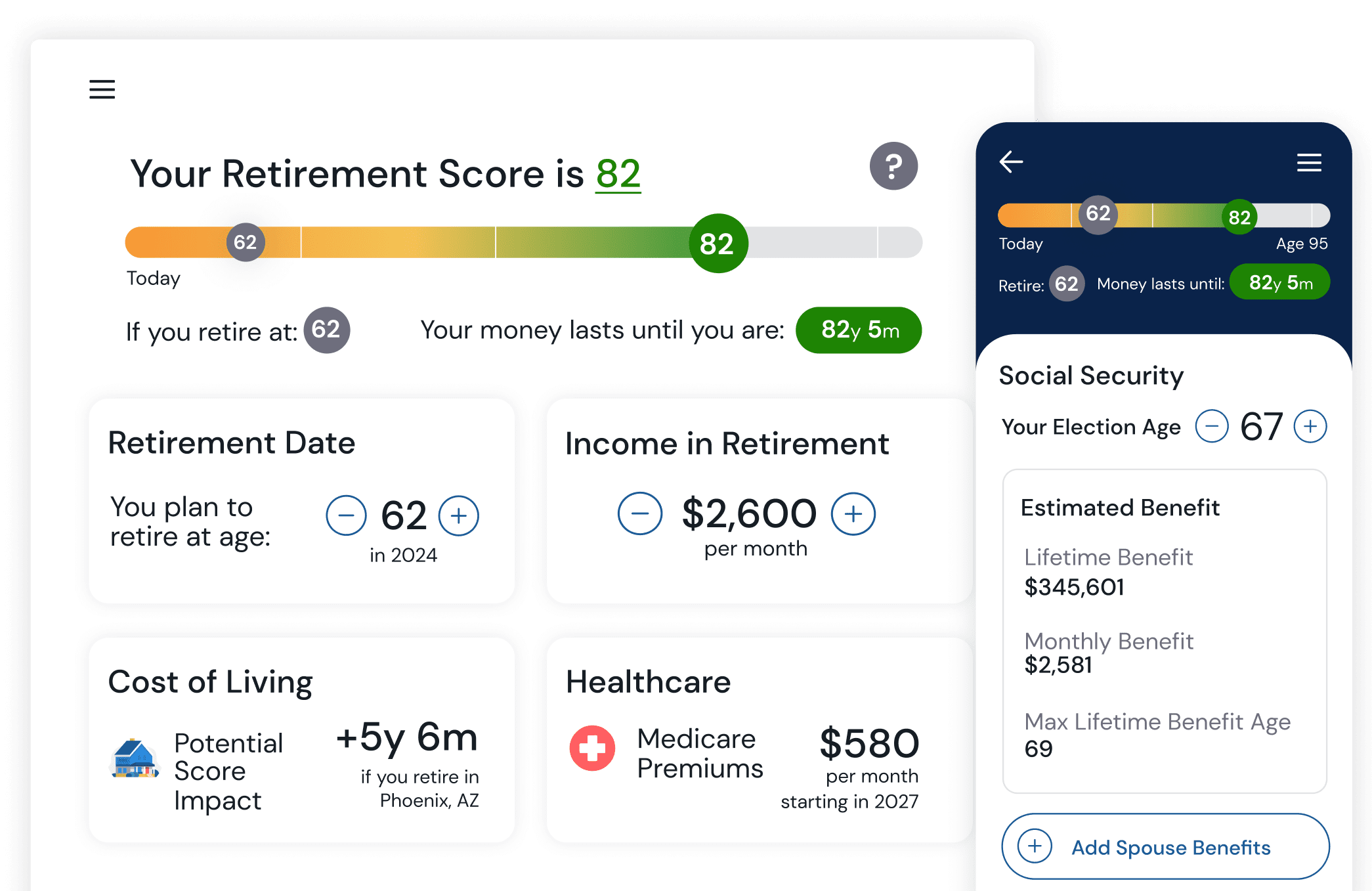

Retirement Simplified is the leading Retirement Financial Wellness solution for credit unions and financial institutions. We provide patent-pending financial tools, including our exclusive Retirement Score, along with timely education that reflects the latest changes in Social Security, Medicare, Retirement Savings Accounts, and more.

Trusted by leading credit unions and financial institutions

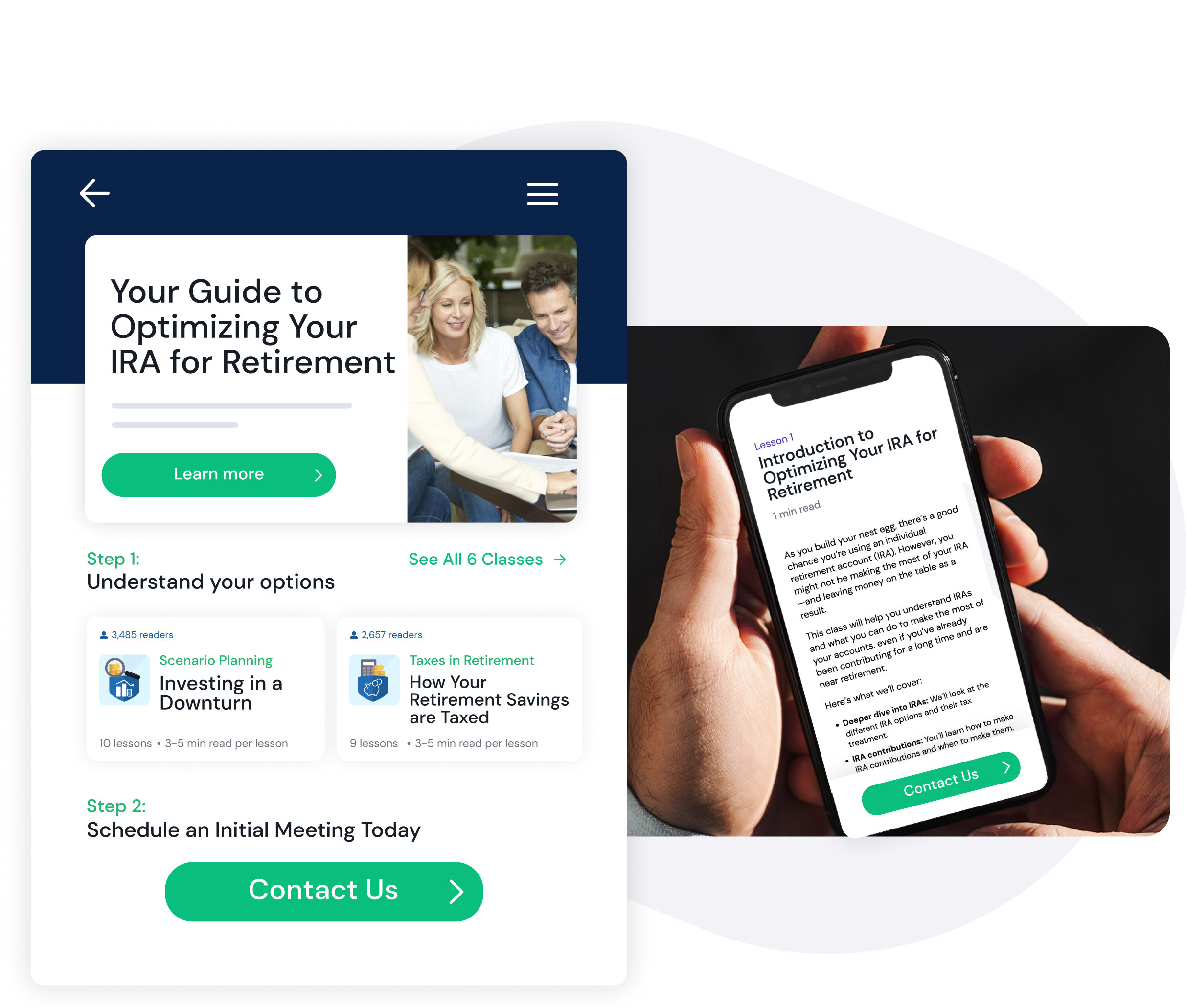

Featured Monthly Classes

13 lessons

2-9 min read per lesson

13 lessons

1-8 min read per lesson

13 lessons

2-9 min read per lesson

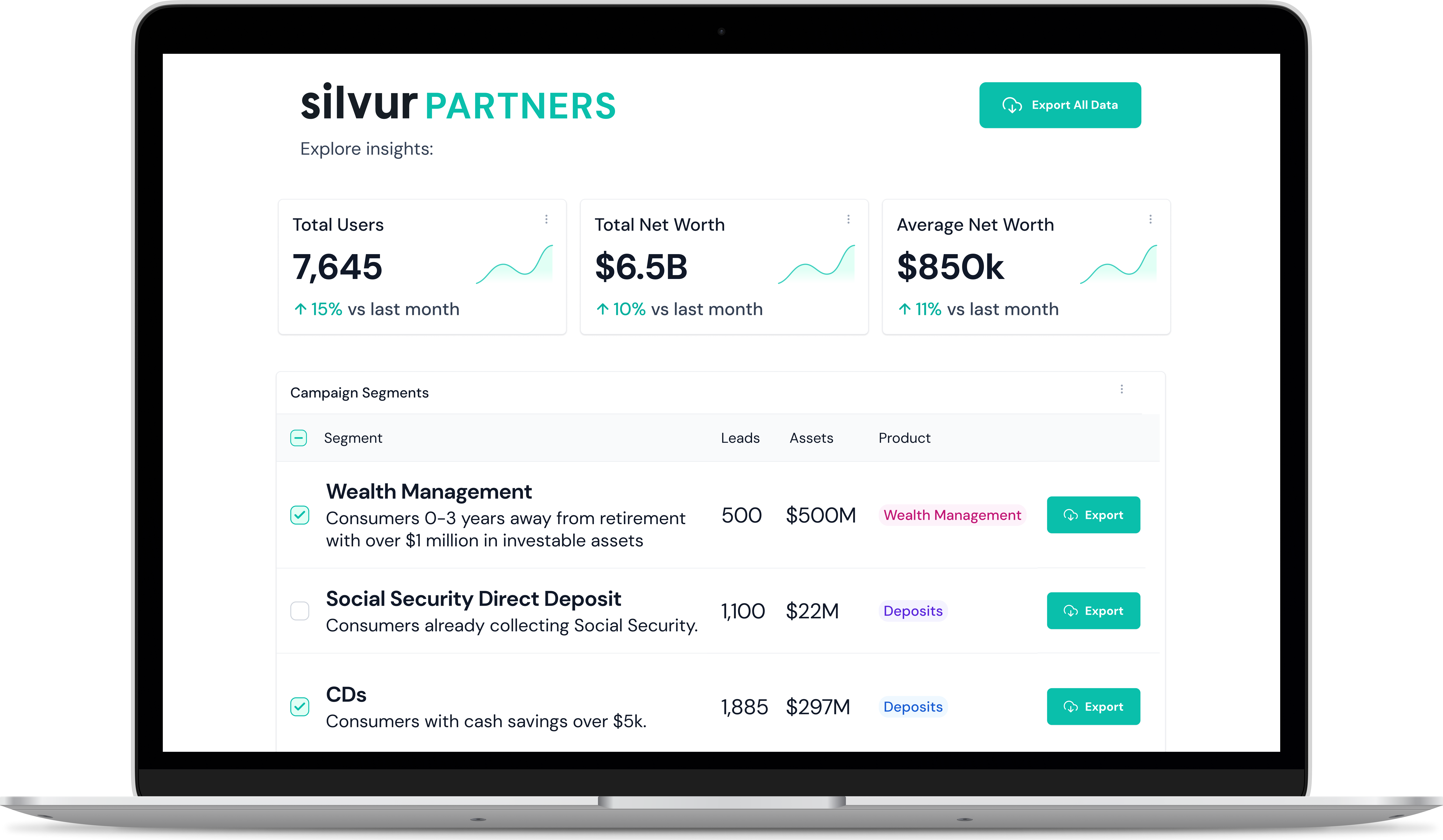

SIMPLE TO LAUNCH

MARKET YOUR PRODUCTS AND SERVICES

EXCLUSIVE TECHNOLOGY

EXCLUSIVE TECHNOLOGY

Case Studies

Learn how Retirement Simplified has helped members and customers across the country.

Case Study

MSUFCU: Helping Members 50+ in Times of Transition & Uncertainty

Explore how MSUFCU was able to provide value through personalized education and tools with Silvur.

Case Study

Social Security's Historic COLA Announcement (Oct. 2022)

Learn how Silvur helped credit union members navigate the highest COLA increase in decades.

Case Study

Always-On Guidance That Validates Your Members' Retirement Plans

Validate your members' Retirement Plans.

Awards and Recognitions